Energy is a key factor in combating climate change, one of the biggest challenges the world is facing today. India has committed to cutting emissions to net zero by 2070 and set ambitious targets for adopting renewable energy. Achieving these targets requires careful planning and an overhaul of our current energy system.

Our work aims at enabling policies that encourage the adoption of rooftop solar, facilitate the development of technology for energy storage, strengthen the grid and transmission infrastructure, advance hydrogen technologies, and promote green mobility. CSTEP's research looks at the various aspects of mainstreaming renewable energy for a cleaner, greener energy sector.

What Are the New Market Opportunities for Indian Developers in Solar + Storage Space?

Solar-plus-storage technology is set for a promising future in India because of rapidly rising electricity demand, ambitious solar targets, higher solar penetration, and falling prices of solar and storage technologies in the nation. As of 31 March 2021, the total power generation capacity in India is 382.15 GW, of which 234.7 GW is thermal and 94.4 GW is renewable energy (RE), with nuclear and hydro accounting for the rest.

Second Life of Batteries

With the Government of India’s (GOI’s) renewed focus on sustainable development and improving the quality of air in the recent budget, cities in India have started integrating electric buses (e-buses) into their fleets. Around 1,000 e-buses are in service at the moment, and nearly 6,500 e-buses are expected to be deployed across the country by 2022. The high purchase cost of batteries, though, is proving to be a major deterrent to the large-scale adoption of e-buses.

Floating Solar in India: The Now and How of It

To keep pace with India’s RE commitments, the Solar Energy Corporation of India (SECI) invited expressions of interest from prospective developers in 2017 to implement 10 GW of floating photovoltaic (FPV) systems by 2022. However, as of July 2019, India has been able to add only about 2.7 MW. Currently, large-scale projects worth ~1.7 GW are under development, which are expected to contribute significantly to the 2020 target. This includes the National Thermal Power Corporation’s (NTPC’s) 100 MW plant in Telangana, India’s largest FPV project.

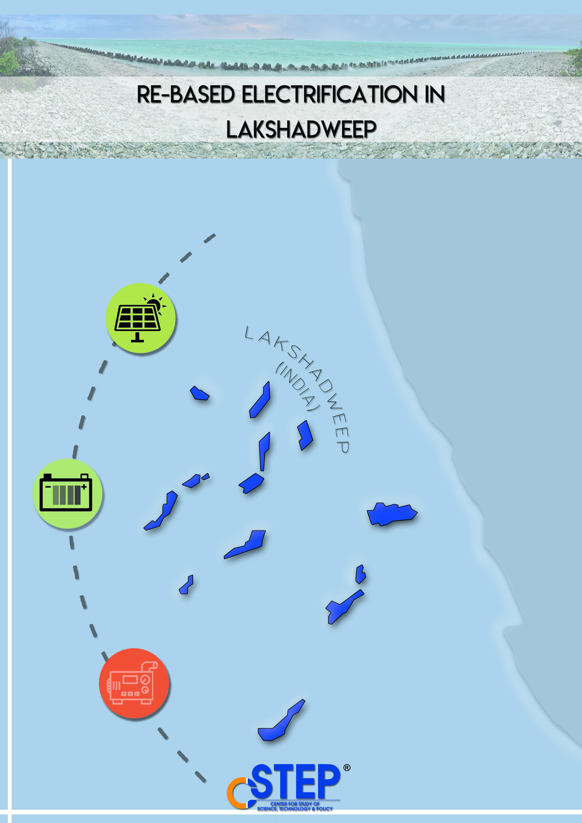

Why renewable energy projects need smart siting

The current government has set an ambitious RE target of 450 GW by 2030. Though RE plants are considered green, they could have unintended impacts. Recent projects in this sector have been troubled by unintended socio-ecological conflicts due to flaws while siting land parcels and inadequate planning.

Energy Storage Considerations: Applications, Issues and Solutions

India has set itself a renewable energy (RE) target of 175 GW and 450 GW for 2022 and 2030, respectively. With the country bracing up to meet these targets, and given the intermittent nature of RE, energy storage systems (ESSs) are required to balance the grid.

Roadmap for KPCL

Karnataka is leading in installed RE capacity among Indian states and has the technical potential for further growth. The state-run power generating company, Karnataka Power Corporation Limited (KPCL), can transition to RE and contribute to the state’s renewable mix. KPCL can also optimize operations of its coal assets by offering generation flexibility through thermal-RE bundling and exploring alternative revenue streams.